The Routefusion difference. Why the best companies work with us.

The Real Problem is: without Routefusion, your team will end up in an endless loop of evaluating providers, integrating providers, doing compliance, upgrading API's, fixing bugs across multiple vendors, and ultimately building a form of Routefusion underneath your primary product.

What is up World!!! According to our blog it’s been a couple years since I have posted, or anyone from Routefusion has. I guess that’s what happens when you are heads- down grinding!! lol

But really, it's been a couple years, and a lot has changed in the world of Routefusion. I wanted to use this time to give readers a quick rundown of why some of the top Fintechs in the world have decided to choose the Routefusion platform to power their embedded FX, local payments, and global bank account products.

To get things going, let's first start off with The Problem that every one comes to us with, and then ill introduce you to The Real Problem that most people don't even know about. We can then finish it all off by talking about the Routefusion difference.

The Problem

Most people come to Routefusion because they are evaluating payment providers for their new FX product, or because they are looking for ways to move customer funds from one country to the other for a marketplace. More times than not they are looking for accounts in different countries for themselves or for their customers. The most common use cases/customers we come across are Fintechs, Lending, Marketplaces, On and Off Ramps, and traditional FI's. The one thing they have in common is they all think their problem is finding a provider. This is where Routefusion comes in, and we introduce them to...

The Real Problem

In 2018 we started Routefusion because when we were building our Neobank and wanted to offer FX payments to our customers, we were overwhelmed by the amount of providers in the market. And we were underwhelmed with the quality of the API's, the service, the coverage, the pricing… the EVERYTHING. Being naive and ambitious software engineers, we thought it made more sense to go out and combine as many providers as we possibly could under one API, and make it easier for future people like us to embed FX and payments. The idea was simple: if you can aggregate the best under one roof, by default you will be the best (much easier said than done 😂😭).

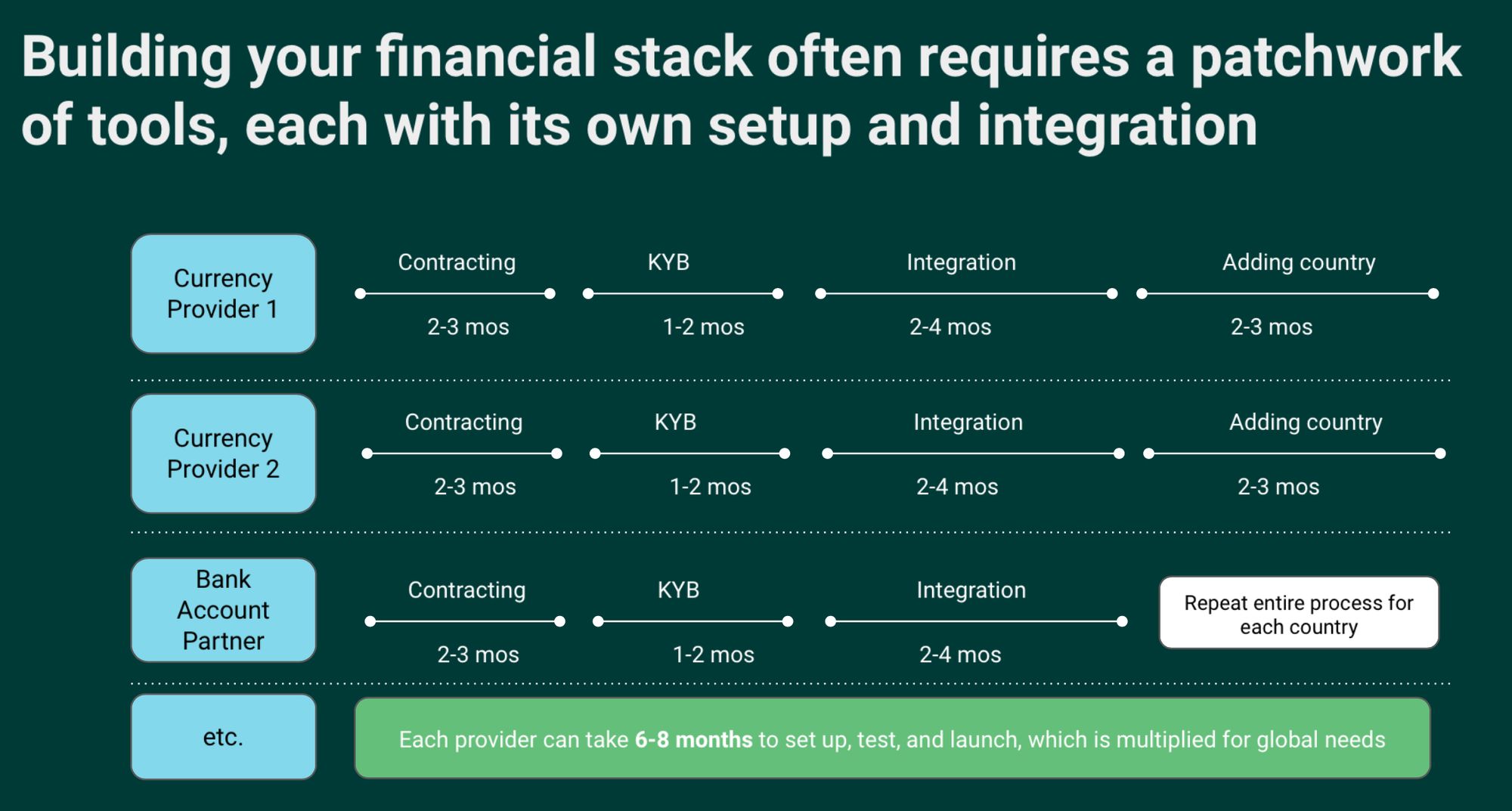

Fast forward to now, the problem is even more prominent than it was back then. The Real Problem is: without Routefusion, your team will end up in an endless loop of evaluating providers, integrating providers, doing compliance, upgrading API's, fixing bugs across multiple vendors, and ultimately building a form of Routefusion underneath your primary product. It takes away valuable time and resources that could be spent building value to your customers, not infrastructure. Below I have a little graphic that illustrates it.

When we break down what the Real Problem is, prospects immediately realize that this process they have been running for the past couple months is something that they are going to have to continue to do in perpetuity, unless they can find someone like Routefusion.

Which naturally you are probably wondering, what exactly is your solution and service, please lay it out for me…

The Routefusion Difference

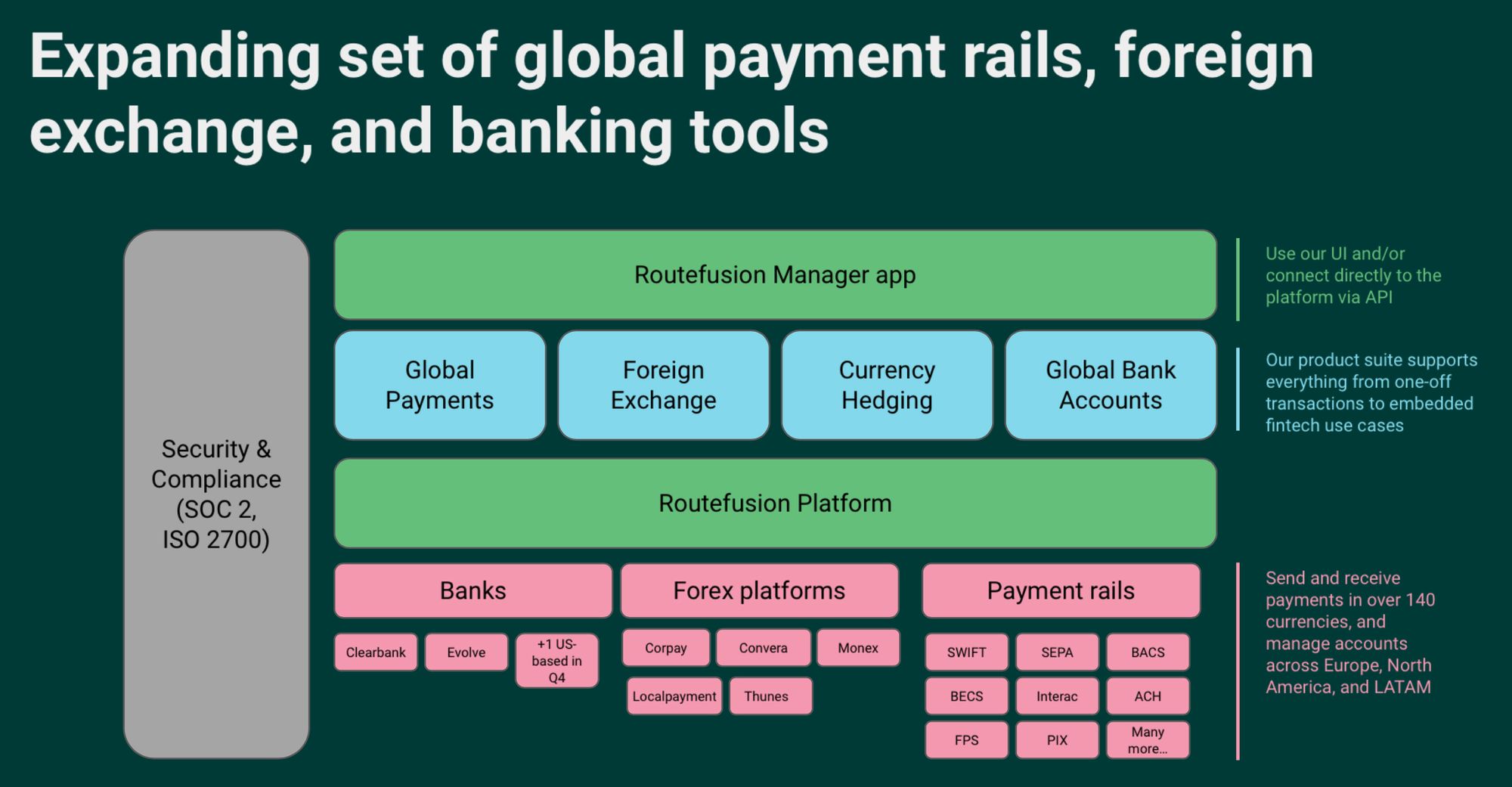

I told you back in 2018 we set out to aggregate all of these providers under one roof, and at the end of the day that is still what we do, but it goes a little deeper than that.

Routefusion is constantly talking with and evaluating new banks, liquidity providers, payment partners, FX houses, etc. We have an entire team called BPI (banking and payments infrastructure) that is dedicated to this. We are looking for new and better ways to surface local payment capabilities, Global Bank accounts, Virtual Accounts, and more cost effective and faster FX rails.

At the same time we are also building out a rock solid compliance program to protect you, our partners, and ourselves from doing anything that regulators wouldn't like. We then bundle all of this into our API and surface it to our customers. What they love, is they get a constant increase in reliability, scalability, and redundancy across their suite of global banking and payment products without having to lift a finger or put an engineer on it! It's like Ruby on Rails when it first came out, it's MAGIC!! Below is an illustration to visualize the Routefusion platform.

How we can help

If you are a product manager looking for new global payment and banking capabilities, or you are a founder starting your company, or an engineer looking into APIs, Routefusion exists because we were once in your shoes. We are building Routefusion to be THE BEST global payments and banking platform in the world for YOU. We literally wake up dreaming of contract negotiations with banks, we workout in the afternoon doing integration tests across new providers, and we fall asleep to the sweet sweet sound of compliance requests hitting our inbox. We live this life so that you can live yours. That's the Routefusion difference, and that's why so many top Fintechs, Platforms, and Marketplaces choose to work with us.

I hope you enjoyed reading this!! Feel free to hit me up on Linkedin or Twitter. Look forward to hearing from you 😀.